Nepal Rastra Bank, the country’s central bank, has approved our partnership with Esewa, Nepal’s leading digital payment platform, to operate remittance services into Nepal.

The partnership means Nepalese in North America and Europe (including the United Kingdom) can continue sending money low-cost, reliably, and at competitive exchange rates to Nepal and other countries across Africa, Asia, Latin America, and Europe.

Why This Matters

Remittances play a vital role in supporting the Nepalese economy. That’s why this partnership with eSewa, Nepal’s most established digital payment platform, demonstrates our dedication to providing innovative services while complying with the Central Bank of Nepal's regulatory frameworks.

The Significance

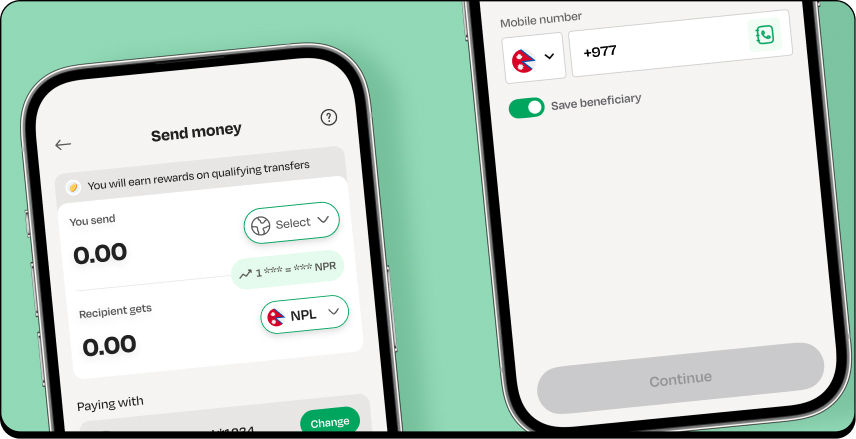

By combining LemFi’s global remittance network with eSewa’s local expertise and infrastructure, we’re creating a more seamless experience for senders abroad and their loved ones in Nepal.

“We welcome every opportunity to demonstrate our commitment to providing accessible and fair financial services for our customers as well as their beneficiaries,” said Muhammad Daiyaan Alam, LemFi’s Head of South Asia Expansion & Growth.

What This Means for You

- Trusted and compliant: LemFi’s services to Nepal now comply with the Central Bank of Nepal’s framework.

- Powered by eSewa: Through our partnership with Nepal’s leading digital payment platform, you can experience even more reliable and secure transfers.

- Affordable as always: You’ll continue to enjoy low-cost transfers and competitive exchange rates backed by a trusted local partner.

Looking Ahead

With over 2 million customers in the United States, the United Kingdom, Europe and Canada, we will continue to demonstrate how cutting-edge technology, strategic partnerships like this, and key acquisitions can deliver secure, reliable, and innovative financial services that are fair and accessible for immigrants worldwide.

.png)