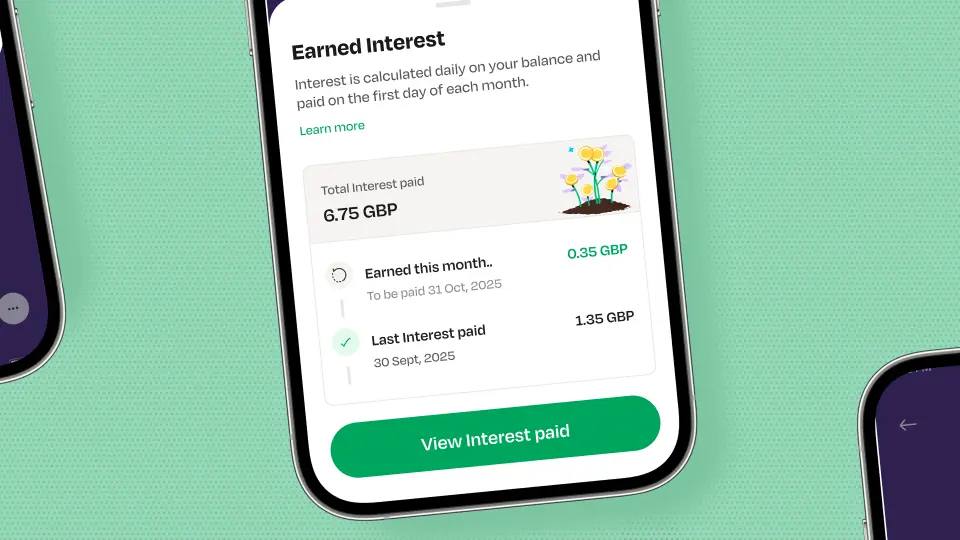

We are excited to announce the launch of our new Instant Access Savings Account, powered by ClearBank, the enabler of real-time clearing and embedded banking. Launching first in the UK, our customers will now earn daily interest on their savings, paid monthly, directly within the LemFi app. This launch significantly expands our mission to build a complete financial ecosystem for the global immigrant community.

What Is LemFi Instant Access Savings?

LemFi Instant Access Savings lets users grow their money within the same app they use for international transfers, simplifying their financial lives. Funds are held securely with ClearBank, a regulated UK financial institution, and are protected up to £85,000 under the Financial Services Compensation Scheme (FSCS).

At launch, customers will enjoy an interest rate of 3.92%, which ranks among the most competitive in the UK compared to the national average of 2.27% for similar accounts. The rate currently tracks the Bank of England’s base rate. We plan to transition it to a variable rate in the near future, allowing us to stay highly competitive for customers seeking flexibility and returns.

Why We Launched LemFi Instant Access Savings

Immigrants play a vital role in the UK economy and global financial flows. In 2023, immigrants in the UK sent more than £9.3 billion in remittances to family and friends. Despite this, many lack access to convenient, trusted savings tools that align with their unique financial behaviours and cross-border needs. In addition, immigrants face significant and widespread issues when accessing credit and banking services more broadly. Approximately 5 million individuals in the UK are considered “credit invisible”, with immigrants from emerging countries disproportionately affected.

This is why bringing savings into the LemFi ecosystem felt like a natural next step. As our Co-Founder and CFO, Rian Cochran, noted, “Many of our users already demonstrate strong saving habits - they just need the right tools to do it confidently and securely in their new country. By embedding savings into LemFi, we’re helping our customers not only send money to family and friends, but also build stability in their new homes.”

It is also a major milestone in our ongoing partnership with ClearBank. Their longstanding commitment to broadening financial access aligns closely with our mission. As ClearBank’s Chief Customer Officer, John Salter, puts it, “Banking should be accessible to everyone. By combining ClearBank’s secure, real-time banking infrastructure with LemFi’s deep understanding of their customers’ needs, we are delivering financial solutions that are accessible, transparent, and built for everyday use, empowering more people to participate fully in the financial system.”

A Step Toward A Broader Financial Future

LemFi’s expansion into savings is part of our roadmap to provide a full suite of financial products tailored to the needs of immigrants. This includes:

- LemFi Credit: This product helps immigrants build and access credit with flexible payment options by recognising international credit histories and using alternative assessment methods.

- Send Now Pay Later (SNPL): Powered by our alternative credit scoring technology, it enables users to send money to loved ones when needed, while accessing credit safely and securely.

Since we launched the Instant Access Savings Account in private beta in August 2025, over 7,000 customers have used it, underscoring strong demand for accessible and immigrant-centred financial products.

.png)